how to calculate a stock's price

NS is the number of shares SP is the selling price per share BP is the buying price per share SC is the selling commission BC is the buying commission. Stock bought at different periods in time will cost various amounts of capital.

A stock price is a given for every share issued by a publicly-traded company.

. Last 12-months earnings per share. Price of Stock A is currently 10000 per share or P0. We can rearrange the equation to give us a companys stock price giving us this formula to work with.

For resolving this problem we created this application in which you. How to Calculate share value Example. The algorithm behind this stock price calculator applies the formulas explained here.

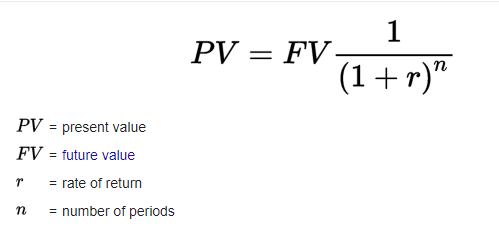

Annual Return Simple Return 1 1 Years Held-1. For example if the firms total common stockholders equity is 63 million and the average number of common shares outstanding is 100000 then the stock prices book value for the firm would be 63. Well there are several different methods available on how to calculate intrinsic value of a stock and also many ways on how to value a stock.

Profit P SP NS - SC - BP NS BC Where. Assume you purchased the financial services stock with a PE ratio of 3 and now you want to calculate the best price to sell. Calculating the Sell Price.

The initial stock pricing is usually decided by the investment bank underwriting it based on the value of comparable stocks company financials experience and. What exactly is the intrinsic value and the question is how to value a stock. In this case the adjusted closing price calculation will be 20 1 21.

Comparing a stocks current trading price to its intrinsic value can show whether its under or over-priced. To compute the average price divide the total purchase amount by the number of shares purchased to. Stock price price-to-earnings ratio earnings per share.

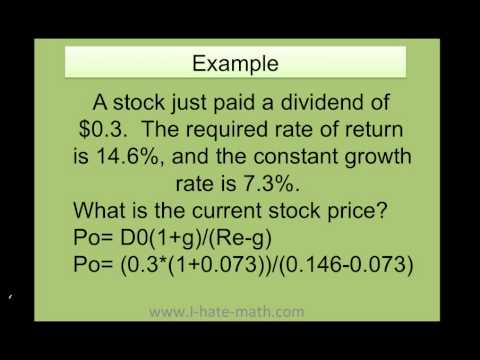

This will give you a price of 667 rounded to the nearest penny. Divide the firms total common stockholders equity by the average number of common shares outstanding. Finding the growth factor A 1 SGR001 Computing the future dividend value B DPS A Calculating the Estimated stock purchase price that would be acceptable C B.

The buying price of stock typically varies every day due to the market. We understand its tough to make a quick move and calculation take time. Announces a 21 stock split.

The price of Stock A is expected to be 10500 per share in one years time P1. Simple Return Current Price-Purchase Price Purchase Price Now that you have your simple return annualize it. Dividends are expected to be 300 per share Div.

Calculating expected price only works for certain types of stocks For newly established companies with rapid growth and unpredictable earnings and dividends future stock price is anyones guess. Book Value per Share. Ad Your Investments Done Your Way.

You can also figure out the average purchase price for each investment by dividing. Sum the amount invested and shares bought columns. If you buy the stock at 3 the PE ratio.

In this case that threshold is 10 and earnings per share have been at 1. Calculate the firms stock price book value from the balance sheet. During a stocks initial public offering IPO the market has not yet had a chance to determine a stocks value.

Divide the total amount invested by the total shares bought. The price is a reflection of the companys value what the public is willing to pay for a piece of the company. Therefore our capital gain is.

You need to back into the price using the industry ratio as a threshold. Intrinsic value Stock price-option strike price x Number of options Suppose a given stock trades for 35 per share. Unique Tools to Help You Invest Your Way.

Annual Dividends per share. It can and will rise and fall based on a variety of factors in the global landscape and within the company itself. Stock Price Average Calculator App helps to calculate the average price of any stock very instantly.

The PE ratio equals the companys stock price divided by its most recently reported earnings per. The most common way to value a stock is to compute the companys price-to-earnings PE ratio. The Stock Calculator uses the following basic formula.

Calculating Todays Stock Prices. In this video you will learn how to calculate the liquidation price in your futures trading no matter its cross margin or isolated margin.

Excel Finance Class 65 Calculate Stock Price At Time T Using Dividend Growth Model Youtube

Capm Calculator Capital Assets Technology Solutions Price Model

What Is Stock Beta And How To Calculate Stock Beta In Python Financial Analysis Business Valuation Cost Of Capital

How To Find The Current Stock Price Youtube

How To Calculate A Stock Average Cost Quora

How To Calculate Weighted Average Price Per Share Fox Business

Common Stock Formula Calculator Examples With Excel Template

A Bulletproof Answer To A Popular Job Interview Question Https Www Youtube Com Watch V Fcjcdpwqsoo Interview Questions Job Interview Questions Job Interview

How To Calculate Future Expected Stock Price The Motley Fool

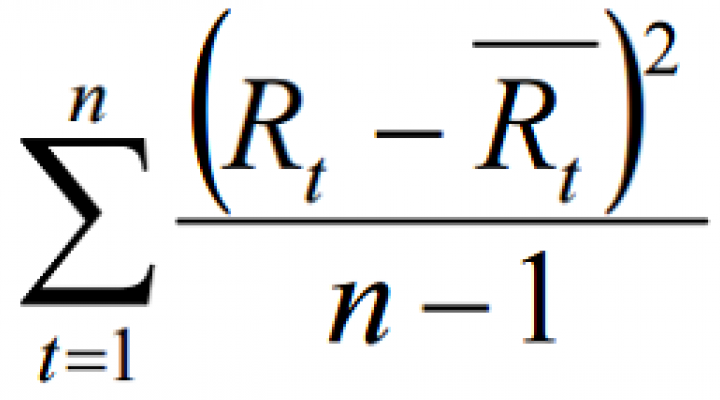

How To Calculate The Historical Variance Of Stock Returns The Motley Fool

2019 Trading Days Calendar Swingtradesystems Com Stock Market Us Stock Market Free Calendar Template

How To Calculate The Historical Variance Of Stock Returns Nasdaq

How To Calculate Future Expected Stock Price The Motley Fool

Intrinsic Value Formula Example How To Calculate Intrinsic Value

How To Calculate Intrinsic Value Formula Excel Template Amzn Example Sven Carlin

Present Value Of Stock With Constant Growth Formula With Calculator

How To Calculate The Issue Price Per Share Of Stock The Motley Fool

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

:max_bytes(150000):strip_icc()/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)